Navigating America’s net-zero frontier: A guide for business leaders

With the United States’ announcement of targets to halve US greenhouse-gas (GHG) emissions by 2030 and reach net-zero emissions by 2050, the world’s largest economy (and second-largest emitter) has joined some 130 nations in its intention to act on climate change. Some 400 large US-based companies have also committed to net-zero targets of their own, many of which have set ambitious emissions reductions targets for 2030 or sooner. In our experience, few have yet turned those pledges into detailed plans for adjusting their business models to thrive in a net-zero economy.

Creating an effective business plan for the net-zero transition won’t be easy, for uncertainty surrounds the pace and scale at which this transition will progress in America and in other countries. That uncertainty has been compounded by the conflict in Ukraine, which has increased the world’s attention to energy security, creating both tailwinds and headwinds for the energy transition. In light of this uncertainty, US companies may wish to assess the business risks and opportunities and the socioeconomic impacts associated with the transition. We believe the companies that understand these factors can better position themselves for long-term success and positive impact. Those that delay action may miss out on growth prospects that should arise as institutions in America and elsewhere strive to eliminate GHG emissions in pursuit of national and corporate targets.

This article is intended as a guide to America’s net-zero transition. It examines four topics critical for business leaders as they shape strategies for this defining decade. First, we describe America’s starting point and trace a pathway that we modeled for achieving federal net-zero targets. Next, based on this pathway, we identify five areas in which climate solutions could offer enormous potential for both emissions abatement and economic growth through 2025: renewable power, electrification, operational efficiency, clean fuels, and carbon capture. We then examine several macro trends that business leaders should anticipate. Finally, we suggest how executives might define their company’s approach to the transition. Even if the transition plays out differently from what our scenario envisions, it appears that a time of climate-focused innovation, investment, and change has arrived—and that leaders would do well to prepare for it.

America’s net-zero frontier

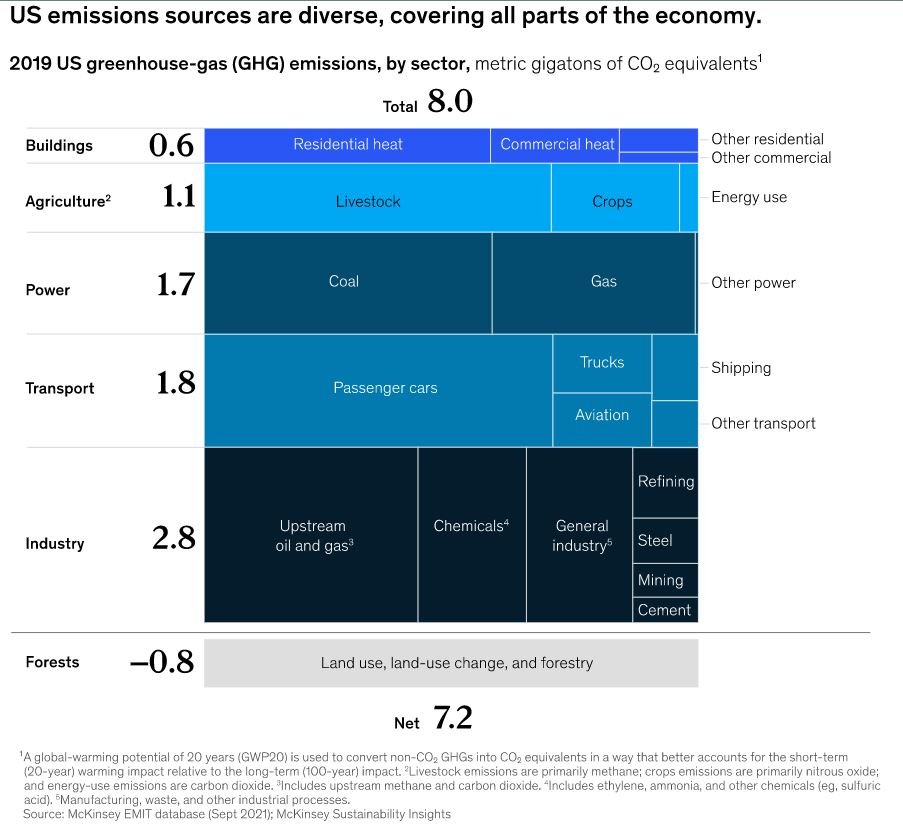

For the United States, the path to net-zero emissions by 2050 entails a comprehensive and rapid effort to decarbonize the economy. A comprehensive effort is necessary because America’s 7.2 billion metric tons of annual GHG emissions come from a variety of sources, spanning every sector (Exhibit 1). While there is a range of future decarbonization scenarios, our pathway modeling highlights a few points of emphasis for America’s net-zero transition:

Reducing emissions from existing facilities and infrastructure is a major part of the decarbonization agenda. Much of the necessary reduction can come from retrofitting emissions-intensive assets, such as chemical, manufacturing, and power plants, through electrification, the use of low-emissions energy sources (such as hydrogen and biofuels), and carbon capture.

Decarbonizing transport presents challenges. Airplanes, cars, trucks, and ships produce around one-quarter of US emissions. Transportation emissions could be eliminated through a mass shift to zero-emissions powertrains that run on electricity, carbon-neutral fuels, or hydrogen. However, the decarbonization of transport is subject to inertia created in part by the United States’ large stock of vehicles and airplanes, poor rail infrastructure, and long journey distances.

Natural gas and methane emissions are significant. The US power sector’s shift from coal to natural gas as a primary fuel has led to a significant reduction of emissions since 2005. CO2 emissions from natural-gas combustion now account for more than 20 percent of US GHGs, and methane emissions from all sources account for another 25 percent. To reach net zero, our analysis shows that at least 60 percent of the natural gas that’s now being used would need to be replaced by zero-carbon energy sources, primarily in the power, manufacturing, chemicals, and buildings sectors. And methane emissions from venting and from fugitive leaks in oil and gas production would need to be curbed by nearly 80 percent by 2030.

Abundant natural resources can support deployment of climate solutions. Resources such as sunlight and wind for generating renewable power and geological capacity for storing captured CO2 could enable the United States to deploy climate solutions such as renewable electricity, hydrogen, and direct air capture at large scale and low cost. The managed forestland of the US interior, a vast carbon sink, already offsets more than 10 percent of gross domestic CO2 emissions and could help the US go beyond net-zero emissions and become “carbon negative.”

Exhibit 1

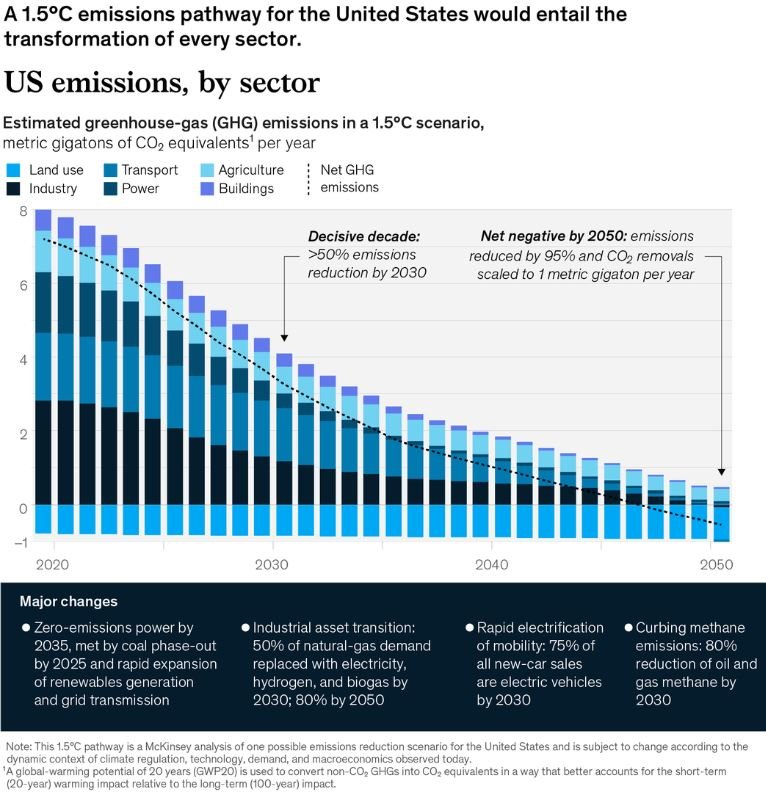

As for the pace of America’s net-zero transition, it will take accelerated action to halve emissions by 2030 and bring them to net zero by 2050 in accordance with federal goals that honor the 2015 Paris Agreement. (Other federal goals call for achieving 100 percent clean-power generation by 2035 and, under the Global Methane Pledge, reducing methane emissions 30 percent by 2030. Furthermore, 24 US states, representing 40 percent of national GDP, have set net-zero targets.) Our analysis indicates that to reach its 2030 target, the United States would need to cut emissions by 6.0 percent per year—nearly ten times faster than the 0.8 percent average annual reduction of the previous decade (Exhibit 2).

Exhibit 2

It will not be easy for the United States to reduce emissions at a pace consistent with limiting global warming to 1.5°C. The transition is likely to be disorderly at times, but our analysis shows how it might be done (Exhibit 3). The emissions pathway that we modeled is one of many the United States could take; it is not a forecast. It calls for bringing together the nation’s rich natural resources and its immense stores of human, financial, and technological capital to deliver a range of climate solutions, which we describe below. This innovation-centered approach, we believe, could allow US-based companies to grow and thrive during a net-zero transition, while enabling the nation to reach its climate goals.

Exhibit 3

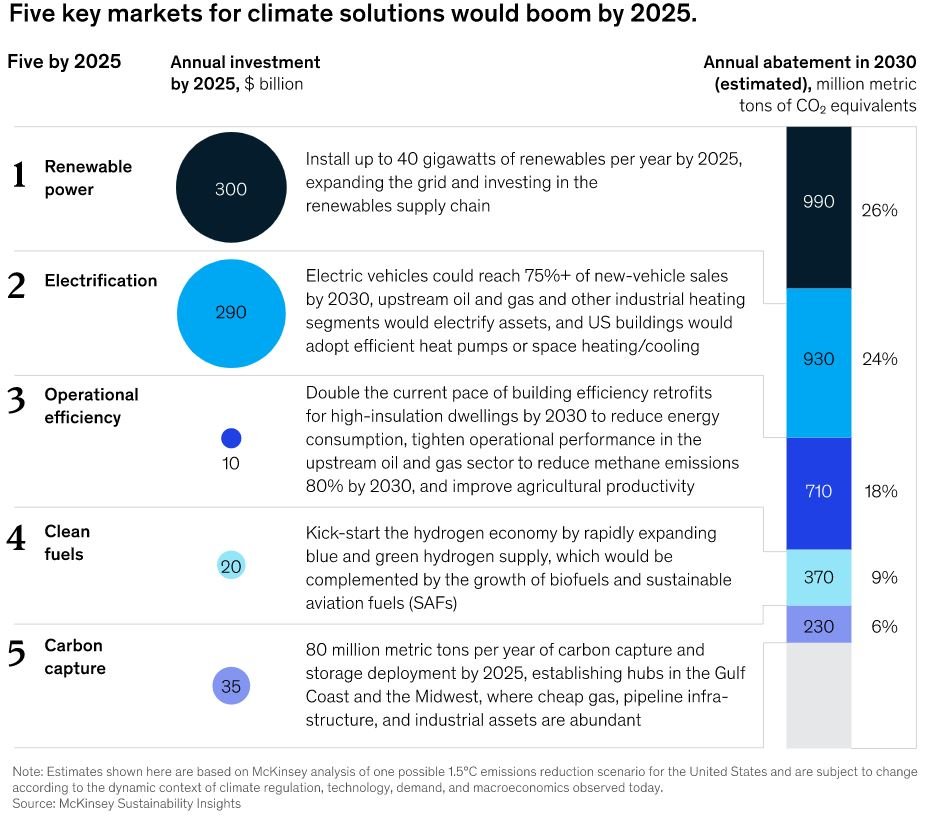

Five high-potential climate solutions for 2025

In the emissions-reduction scenario we developed, five cross-sector climate solutions would reduce GHG emissions 25 percent by 2025 and 45 percent by 20303 —more than the federal target and in line with the global goal of limiting warming to 1.5°C. These solutions would require capital spending of some $650 billion per year by 2025, which in turn would create growth opportunities for companies. The key solutions focus on renewable power, electrification, operational efficiency, clean fuels, and carbon capture (Exhibit 4).

Exhibit 4

Renewable power. In a net-zero scenario, the country’s energy system would be reconfigured. Indeed, the United States has set a target to create a “carbon-pollution-free power sector by 2035.” Energy consumption would shift away from fossil fuels, which provide 90 percent of primary energy today, and toward renewables, which would produce just over 75 percent of primary energy in 2050. This shift would result in more than 35 percent of the emissions reduction that is needed in 2025 and more than one-quarter of the reduction in 2030.

To expand the use of renewable power, the United States would install 40 gigawatts per year of renewable capacity in 2025. By 2030, the installation rate for renewables would reach 100 gigawatts per year, three times what it is now, as utilities tap the best solar resources from Texas to California and wind resources in the Midwest. Utilities would also build out power grids and modernize them with flexibility resources including storage and dispatchable low-carbon power (for example, gas power plants with carbon capture, utilization, and storage) to prevent interruptions in electricity supply. Makers of renewable-electricity and storage equipment would expand production capacity to meet this demand, supporting $300 billion of capital investment per year by 2025.

Electrification. The single most capital-intensive climate solution is the replacement of equipment that burns fossil fuels with equipment powered by electricity. (For this solution to reduce emissions significantly, the electricity would need to come from the renewable sources described above.) Cars and trucks with gasoline and diesel engines would be phased out nationwide in favor of electric vehicles (EVs). In every major metropolitan area (including Chicago, Dallas–Fort Worth, Los Angeles, New York, and Washington, DC), buildings that rely on oil- or gas-fired furnaces would instead be kept warm by electric heaters and heat pumps. And in major manufacturing hubs, such as the Gulf Coast, factory owners would install a wide array of new electric machines. Meeting the nation’s electrification needs would take $290 billion of capital spending per year by 2025, according to our analysis. Electrification would account for roughly 15 percent of the emissions reduction needed for a net-zero pathway in 2025, one-quarter of the reduction in 2030, and more than one-third in 2050.

Operational efficiency. Improving operational efficiency represents the third-largest source of emissions savings, accounting for about one-fifth of the necessary reduction in 2025 and 2040. It is also the least capital-intensive solution, requiring an investment of $10 billion by 2025. Opportunities to boost efficiency span sectors. Building owners, for example, could insulate existing buildings to reduce their energy consumption, particularly in colder regions such as the Northeast. Upstream oil and gas companies could stop flaring and venting emissions and enhance leak detection and prevention technology, primarily in the oil and gas fields of West Texas’s Permian Basin. Farm operators could use genetic technologies and other techniques to improve the GHG efficiency of livestock in ranching areas, such as Kansas, Montana, and Wyoming.

Clean fuels. The shift toward renewable power would also expand production of green hydrogen, which would serve as a zero-emissions energy carrier and as a clean-fuel feedstock for hard-to-abate sectors. The US Department of Energy’s “Hydrogen Shot” initiative4 aims to reduce the cost of clean hydrogen 80 percent in one decade, to $1 per one kilogram, which would bring hydrogen much closer to cost parity with natural gas for most applications.5 Our analysis suggests that by 2030, US output of green hydrogen and blue hydrogen could reach three million metric tons per year. By 2050, hydrogen and hydrogen-based fuels would meet about 15 percent of US final energy demand. Other clean fuels, such as biofuels, could replace fossil fuels in applications where hydrogen is less practical, notably aviation. Regions that have both the resources to supply these fuels and the demand for them from local industries could become important hubs for clean-fuel adoption; these regions include Chicago, Houston, and Los Angeles.

Carbon capture. The US Gulf Coast and the Midwest have qualities that make them well suited to serving as hubs for carbon capture and storage. They are home to many emissions-intensive industrial sites, such as chemical plants. And their extensive gas pipeline infrastructures might transport captured CO2 into their natural underground reservoirs. What the regions lack is equipment for capturing CO2 from the flue gases of industrial facilities and transporting it to a permanent storage location. Filling this need would require capital spending of $35 billion per year. With such infrastructure in place, companies that also switch to bio-based fuels could consider their assets carbon negative.

Macro trends during the net-zero transition

The five climate solutions described above would come with profound changes in America’s economy and industrial systems, including employment shifts, asset stranding, and capital reallocation. To mitigate risks and realize growth prospects as the transition advances, companies will want to anticipate these developments, think through their implications, and plan strategies for responding. Companies and government agencies, too, could consider various policy interventions to manage socioeconomic impacts. Below, we look at four significant trends in detail.

Accelerated deployment of climate technologies and infrastructure

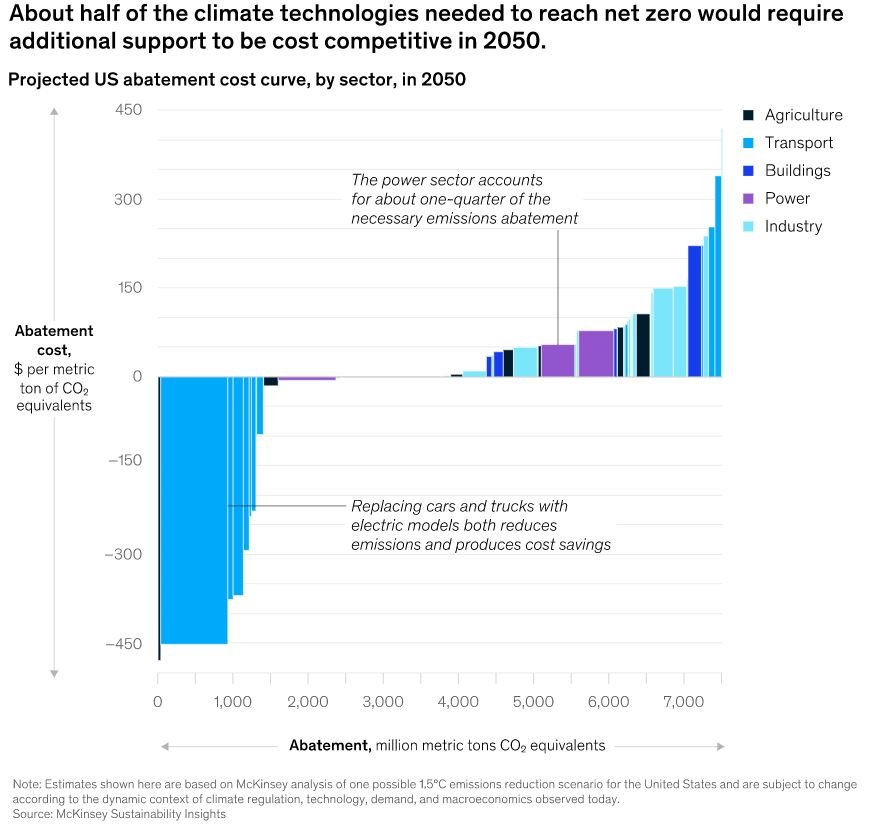

Most of the technologies that enable climate solutions are known. On the emissions pathway we have described, nearly 90 percent of the abatement needed by 2025 could come from two sets of technologies: those that can be considered mainstream, insofar as they are mature, commercially viable, and being widely deployed, such as solar-power generation; and those that are in the early stages of adoption, such as heat pumps (Exhibit 5). Solar-power installations, for example, would go up eightfold, from five gigawatts per year in 2019 to 40 gigawatts per year in 2030.

Exhibit 5

Deployment of mainstream and early-stage climate technologies will also require new infrastructure: charging stations and battery supply chains for EVs; rare-minerals supply and transmission lines for renewables; electrolyzers to make hydrogen and pipelines to transport it. This expansion could allow companies to invest in developing new low-emissions capital projects and in decarbonizing existing assets.

Shifting economics of abatement

The cost of climate solutions is declining quickly as technologies mature. Our analysis suggests that, in the aggregate, organizations could presently abate some 40 percent of US GHG emissions at no net additional cost, or even save money by doing so. And because innovation and economies of scale should lower technology costs over time, we believe it may be possible for companies to abate another 10 percent of emissions without cost increases by 2050.

Even so, we find that about 50 percent of GHG emissions in 2050 would likely need to be addressed with climate technologies that cost more than conventional technologies (Exhibit 6). The most expensive climate technologies—at more than $150 per metric ton of CO2 abated—include sustainable aviation and marine fuels, direct air capture of CO2, and electrification of high-temperature industrial heat. Companies are unlikely to take on additional costs voluntarily, particularly if current inflationary trends in the United States persist. Therefore, the investments needed to achieve net zero might take place only if companies face changes to public policy or new demands from shareholders—including investors, joint-venture partners, and customers, as we discuss below.

Exhibit 6

Significant capital spending

Deploying climate solutions at scale would require large capital spending: $27 trillion through 2050 ($900 billion per year, on average), according to our estimates under the 1.5°C decarbonization scenario.7 This spending is equal to 4 percent of 2021 GDP, or 13 percent of capital outlays across the US economy in 2021. Our analysis suggests that nearly four-fifths of the total investment would be needed for mainstream and early-adoption technologies; the rest would be devoted to nascent technologies.

Our analysis suggests that much of this capital would be used to decarbonize or phase out existing high-emissions assets before the end of their useful life as part of managing the challenge of stranded assets. Alongside systemic interventions supporting a transition to net zero, such as climate policy or technology innovation, organizations could use a catalog of financing mechanisms that may facilitate the deployment of capital and improve the risk/return profile of deals. These mechanisms could include raising debt capital through loans that provide low-cost funding if sustainability performance goals are met, generating carbon credits (from emissions abatement resulting from decarbonization retrofits) that could be sold to voluntary carbon markets, and securitizing loans to the owners of low-carbon assets and using funds from those securities to finance the decarbonization of high-emissions assets.

In financing the decarbonization of existing holdings, it would be wise for asset owners and investors to manage reputational or financial risks from their portfolios’ exposure to high-carbon assets, create standards and tools for evaluating and implementing decarbonization investments, and maintain service to customers.

Value-chain decarbonization led by companies

As mentioned earlier, hundreds of US-based companies have set net-zero targets for themselves. Many of these targets apply to the emissions from not only their own operations but also their suppliers and the use of their products. Similarly, the White House issued an executive order in December 2021, calling for the federal government to buy zero-emissions goods and services in categories ranging from electricity to vehicles to building materials. Commitments such as these could put pressure on businesses to decarbonize, even if they themselves have not yet set emissions targets (Exhibit 7).

Exhibit 7

Some automakers with net-zero targets, for example, have prompted decarbonization in their supply chains by committing to purchase low-emissions or zero-emissions versions of inputs such as steel. Steel producers, in turn, are beginning to build plants that make green steel and to source iron ore from mining companies that are lowering their carbon emissions. Effects such as these are likely to ripple throughout the economy. Even companies whose operations are not emissions intensive may find it advantageous to decarbonize their value chains, whether to fulfill demands from customers, to adapt to changes in the costs of key inputs, or to deal with other material business issues.

Decisions and actions for business leaders

Although the pace of America’s net-zero transition is uncertain, the direction is clear, as are the opportunities and trends that could emerge. Companies that prepare now could gain an edge. Below, we outline a few questions that may help executives decide how their companies should move toward America’s net-zero frontier.

Where would my current business stand in a net-zero economy? For companies that are just beginning to think about what the net-zero transition could mean, it may be useful to envision the US economy in 2030 under a 1.5°C scenario: larger markets for low-emissions goods and services and smaller markets for high-emissions goods and services; new zero-emissions assets working alongside decarbonized legacy assets; competitive advantages for companies whose offerings feature low climate impact along with traditional desired qualities such as cost effectiveness and reliability. Exercises such as this have compelled some US companies to begin overhauling their business models and portfolios. Companies could start with developing (or acquiring) capabilities to analyze the exposure of one’s core business to risks and opportunities under different decarbonization and warming scenarios.

What moves could my company make to create value in a net-zero economy? Rising demand for climate solutions should create growth opportunities in virtually every sector. To capture them, businesses could expand their net-zero playbook—going beyond defensive moves, such as analyzing and reporting risk exposures, to make value creation a priority. Here are four ways that leading companies are seizing early advantages.

Portfolio transformation. Some companies that have reoriented their business portfolios toward the growth segments of the net-zero economy have begun to outperform their slower-moving rivals. They are shifting resources away from business units that compete in markets where growth is likely to slow or even go into reverse (for example, power-generation companies shifting investments from coal-fired capacity to renewables) and reconfiguring assets to provide value in a net-zero economy (for example, those same power-generation companies investing in carbon-capture-and-storage retrofits for their existing gas plants).

Green business building. In addition to realigning the core business, leading organizations are investing in new, scalable business models to serve fast-growing markets for climate technologies and low-emissions goods and services such as green steel.

Green premiums. In markets for goods such as plastic and steel, customers are already willing to pay a price premium for offerings with legitimate green attributes. As the race to procure green materials heats up, more products could command such premiums.

Decarbonized operations. Our experience suggests that many technologies and operational changes that can reduce emissions have a positive net present value—thus providing companies with a sound rationale for decarbonizing to a certain degree. If improvements in environmental performance also let the company charge a green premium, the case for decarbonization could become even more compelling.

What partnerships can help my company thrive? Reaching net zero requires extensive changes for most companies, including changes to capital allocation, operations, and performance management. Some changes will be possible only if other entities also make changes; for example, mass uptake of electric vehicles depends significantly on the utility sector expanding grid capacity to support charging networks. In these cases, companies may find it helpful to join other organizations in addressing shared needs, such as the need for industrial-scale networks in hydrogen production and distribution.

The net-zero scenario described in this article is one path that the United States could take—a path entailing rapid transformation across multiple sectors. Although other outcomes are possible, commitments by government entities and businesses make it likely that some degree of technology adoption, innovation, capital spending, and value chain decarbonization will happen. The sooner that companies act on the opportunities emerging across America’s net-zero frontier, the better off they could be in the long run.

Fuente: Mckinsey