Blog

Balance 2024 y proyecciones 2025

En 2024, protegimos proyectos clave y crecimos internacionalmente. Miramos a 2025 con optimismo, esperando nuevas oportunidades y expansión.

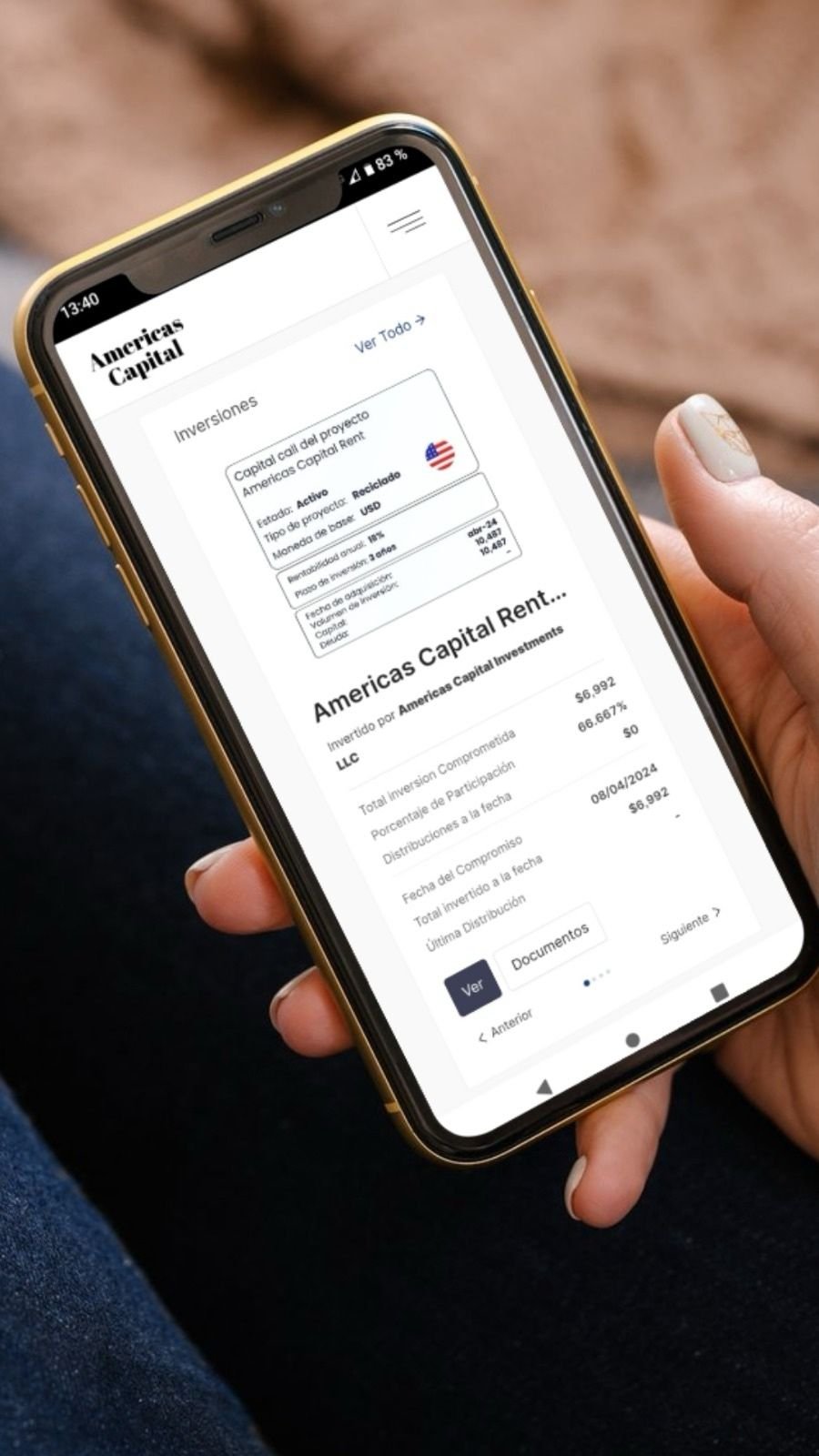

Plataforma para inversores

Lanzamos una plataforma exclusiva para inversores, donde podrán gestionar sus activos y acceder a información actualizada al instante.

Grandes Familias Argentinas y su Legado en las Inversiones: Nuevos Episodios de 'Dueños del Mercado'

Descubrí el legado de grandes familias argentinas en el mundo de las inversiones con 'Dueños del Mercado'. En la segunda temporada, Facundo Sonatti entrevista a líderes como Manuel Santos Uribelarrea y Agustin Otero Monsegur.

Tendencias Globales en Real Estate 2025

Los indicadores emergentes para 2025 presentan un panorama favorable para el Real Estate, impulsado por la reciente disminución de las tasas de interés, lo que marca el inicio de una nueva fase de expansión.

Oportunidades Build To Rent en el Reino Unido

El mercado de real estate en el Reino Unido continúa presentando grandes oportunidades de crecimiento, especialmente en el segmento de Build to Rent (BTR), que ha demostrado ser una solución eficaz para la creciente demanda de vivienda de alquiler a largo plazo.

Libre mercado y baja de tasas en Estados Unidos: buen augurio en Real Estate.

Las elecciones del 5 de noviembre han catapultado a Donald Trump a su segundo mandato, con el Partido Republicano asegurando 295 electores frente a 226 de los demócratas. Con un enfoque en el libre mercado, se espera un gobierno fuerte y respaldado por el voto popular, lo que podría tener efectos significativos en el comercio, las finanzas y el crecimiento global.

Ampliamos proyectos en U.K.

Te contamos en pocas palabras por qué elegimos diversificar nuestras carteras de inversión en U.K., con nuevas propuestas en una de las economías más potentes del mundo.

Time to invest: what are the areas in the sights of large funds?

Sectors such as biotechnology, real estate and infrastructure are the ones that arouse most interest among investor groups.

Rethink Summit: more than 300 entrepreneurs discussed Argentina's role in the global investment ecosystem

In the first edition of the forum, investors agreed on the need to take advantage of the low international interest rates and highlighted the country's potential in terms of human and natural resources, although confidence must be generated in the long term.

More than 300 entrepreneurs anticipate a new wave of entrepreneurial capital

As a result of the drop in interest rates, VC funds will once again set their eyes on the region. Which sectors in Argentina can benefit

RepensAR Summit: capital leaders meet to discuss the future of investment in Argentina

The event, which will be held in different round tables, will address key topics such as real estate, private equity, wealth management and key sectors of the economy such as agriculture, mining and infrastructure.

More than 300 entrepreneurs met to discuss Argentina's role in the global investment ecosystem

In the first edition of the RepensAR Summit, investors agreed on the need to take advantage of the low international interest rates and highlighted the country's potential in terms of human and natural resources, although confidence must be generated in the long term.

RepensAR Summit: experts met to analyze investments in the country

The meeting was held at MALBA, where almost all the speakers agreed with the outlook for the future.

Milei's Argentina: Lasting change and investment opportunity? This is what 4 funds see

The arrival of the libertarian to the Casa Rosada has generated great expectations regarding capital inflows to the country, but caution persists in the face of the challenge of implementing lasting reforms.

Towards a world-class investment ecosystem

Argentina is at a crossroads to redefine its role in the global investment landscape.

Money "owners" analyze the local investment landscape

For the first time, a group of leading investors will meet in Argentina to study the investment ecosystem and draw long-term guidelines.

Cumbre de inversores RepensAR: "Hay una sensación latente de que es el momento"

The RepensAR Summit event in Buenos Aires brought together leaders in finance to discuss the future of Argentina, highlighting the importance of an investment ecosystem and the need for economic stability.

RepensAR Summit: Capital owners meet to analyze Argentina's investment outlook

For the first time in Argentina, a group of leading investors will meet with the objective of analyzing the current ecosystem and outlining long-term guidelines.